Title loans and payday loans offer distinct financial solutions. Title loans, secured by your vehicle's title, provide lower interest rates and flexible terms for debt consolidation or quick cash access, while payday loans are short-term advances against future income with higher rates due to shorter duration and lack of collateral. Understanding these differences is crucial when choosing between the two to avoid potential debt traps. Borrowers should consider building an emergency fund, seeking support from credit unions, and practicing prudent borrowing by comparing rates and ensuring repayment capability.

Are you considering a title loan or a payday loan to cover unexpected expenses? Both options come with risks, but understanding their differences is key to making a safe financial choice. This article breaks down the intricacies of title loans and payday loans, compares their risks and benefits, and offers alternative solutions to help borrowers make informed decisions. By exploring these options, you can navigate challenging financial situations more securely.

- Understanding Title Loans and Payday Loans: A Comprehensive Look

- Comparing Risks and Benefits: Which Loan Type is Safer?

- Safe Financial Practices: Alternatives and Tips for Borrowers

Understanding Title Loans and Payday Loans: A Comprehensive Look

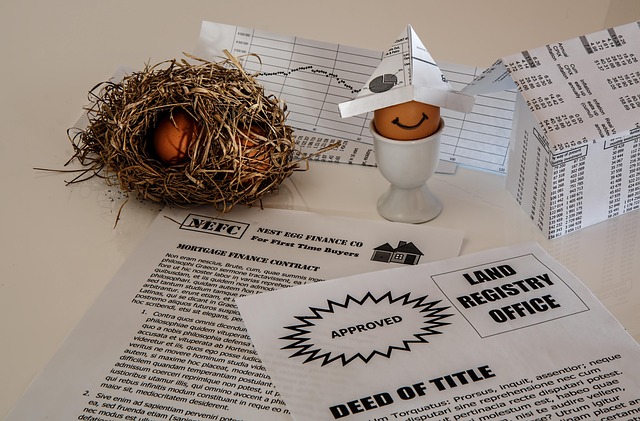

Title loans and payday loans are two distinct financial options that serve different purposes. A title loan is secured by an asset—typically a vehicle—allowing lenders to offer lower interest rates and more flexible terms compared to traditional unsecured loans, like payday advances. When considering a title loan vs payday loan, understanding the intricacies of each is crucial for making informed decisions about managing your finances.

The title loan process involves using your vehicle’s title as collateral, meaning you retain possession of the vehicle while making payments over a set period. This option can be appealing for those seeking debt consolidation or requiring quick access to cash without traditional credit checks. In contrast, payday loans are short-term advances based on your future income, often tied to your next pay cycle, and typically carry higher interest rates due to their shorter duration and lack of collateral. While convenient in emergencies, these loans can trap individuals in a cycle of debt if not managed prudently.

Comparing Risks and Benefits: Which Loan Type is Safer?

When comparing title loan vs payday loan, it’s crucial to weigh the risks and benefits of each option to make a safe financial decision. While both types of loans offer quick approval, they differ significantly in their requirements and implications. A payday loan typically relies on an individual’s next paycheck as collateral, leading to high-interest rates and short repayment periods. This can trap borrowers in a cycle of debt. In contrast, a title loan uses the equity in one’s vehicle as collateral, offering lower interest rates and longer terms. However, failing to repay a title loan could result in losing one’s vehicle.

Considering the vehicle collateral and quick approval, title loans may present a safer choice due to their structured repayment plans and reduced risk of unlimited debt accumulation. Nevertheless, borrowers should carefully evaluate their financial capacity before opting for either type of loan.

Safe Financial Practices: Alternatives and Tips for Borrowers

When considering short-term financial solutions, borrowers often weigh the options of a title loan vs payday loan. While both offer quick access to cash, understanding the nuances between them is crucial for adopting safe financial practices. A title pawn, where you use your vehicle’s title as collateral, may provide higher borrowing amounts but poses greater risk if you’re unable to repay, potentially leading to loan payoff difficulties and even title transfer consequences.

In contrast, payday loans, despite their lower borrowing limits, are typically structured for immediate repayment on your next paycheck, avoiding the encumbrance of asset transfer. To make informed decisions, borrowers should explore alternatives like building an emergency fund, seeking assistance from credit unions or community organizations, and practicing responsible borrowing by comparing rates, understanding terms, and ensuring repayment ability before taking out any loan.

When considering short-term financial solutions, understanding the differences between title loans and payday loans is crucial. While both offer quick access to cash, a thorough comparison reveals distinct risks and benefits. Title loans, secured by your vehicle, present a lower risk for lenders, potentially leading to more favorable terms. However, failing to repay can result in losing your asset. Payday loans, on the other hand, carry higher interest rates and shorter repayment periods, making them a less sustainable option.

Adopting safe financial practices involves exploring alternatives like building an emergency fund or seeking assistance from credit unions. Educating yourself about these loan types empowers you to make informed decisions, ensuring a more secure financial future. Remember, understanding your options is key to avoiding the potential pitfalls of title loans and payday loans.